Resisting Commoditization as a Specialty Chemicals Supplier

“Good morning, Mrs. Smith. Shall I have your car pulled around to the valet station and brew your regular latte for your journey?”

Being a specialty chemicals or polymers purveyor is much like being a fine concierge. A top concierge can anticipate his client’s needs, as well as how to accommodate aberrations from routine. The specialty chemicals maker develops a similar level of customer intimacy, offering solutions uniquely customized to each customer’s processes, sales cycles, and end use application requirements. Both the concierge and the specialty chemicals maker excel at solving complex problems, thereby creating exceptional value for their customers.

But that isn’t the only similarity. Just as the concierge role has been obsoleted (or at least challenged) by the ready availability of reservation apps and online check-ins, specialty chemicals purveyors today face several looming threats to their business. Market share is shifting to providers in Asia, whose rapid capacity expansion is driving commoditization downstream. Integration across the supply chain has only exacerbated price erosion, and as major players escalate merger activity, many companies are struggling to anticipate future supply and competitor arrangements.

It’s tempting to follow the path of least resistance and shift the focus of your marketing strategies. After all, plenty of hotels have gotten away with installing touch-screen kiosks where there was once a human being; why shouldn’t chemicals companies start competing more on contracting and pricing than on performance? However, if you aren’t quite ready to install a permanent “Off Duty” sign on your lobby desk, you do have some options. In observing our clients and other prominent players in the space, both small and large, we’ve identified three key paths to remain “specialty” – with above average revenue growth and healthy margins – in an increasingly commoditized world:

Build Customer Intimacy

The high-end hospitality segment understands that even in a highly competitive and cost-conscious market, customer service is not the place to cut corners. Similarly, despite an alarming trend toward reduced R&D investment in specialty chemicals, SG&A spend has been flat across the category – and we predict that winning companies are getting smart about where that money is going.

Even players who aren’t willing or able to invent new molecules or completely new chemistry for each customer need can differentiate by offering a more complete solution – e.g., chemistry plus some element of service or applications support (early morning wake-up call, anyone?). Investing a bit more time with either general sales support or specialty applications support for engineering or product design is a great way to get traction with customers and increase their preference for your product.

Innovation centers focused on design or technology development are an increasingly popular venue for this type of relationship-building. Just as luxury hotels make a point of providing a completely seamless hospitality experience, many of these centers are painstakingly designed to cater to customers’ needs. Earlier this year, for instance, 3M opened a state-of-the-art Innovation Center in Washington D.C., bringing in-depth demonstrations of its broad capabilities right to their East Coast clients’ door, and making it easier for them to participate in collaboration and co-development with 3M scientists and sales professionals.

Offer a Menu of Unique Solutions

Personalized products and service are a critical aspect of successful customer engagement, but for large specialty chemicals companies, the costs of individualized customization can add up fast. Fortunately, over the past two decades, digital sales channels and software have unlocked new opportunities to please everyone without breaking the bank.

For example, in the early 2000s, Dow Corning recognized a growing trend of price-conscious buyers for standard silicones and launched a new brand to serve them. XIAMETER® silicones were still produced by Dow Corning, but were marketed separately through an online channel, opening up access to the low end of the market without impacting the Dow Corning brand. The result was that online sales rose to 3X the industry average and the “price seekers” – wanting affordable prices and more basic support – were successfully segmented from the “innovation seekers” – wanting some “extra fluff” in their service offering to complement the product delivered. The brand has continued to evolve, expanding its pricing tiers and distribution networks to keep pace with the changing market.

Balance the Portfolio for Growth and Profit

Investing in innovation – both technically and commercially – is key to sustainable organic growth in specialty chemicals. But to keep reality in check (and avoid a gasp at the final envelope upon check out), portfolio management around margins will help keep your chemistry as palatable for your internal stakeholders as it is delightful for customers.

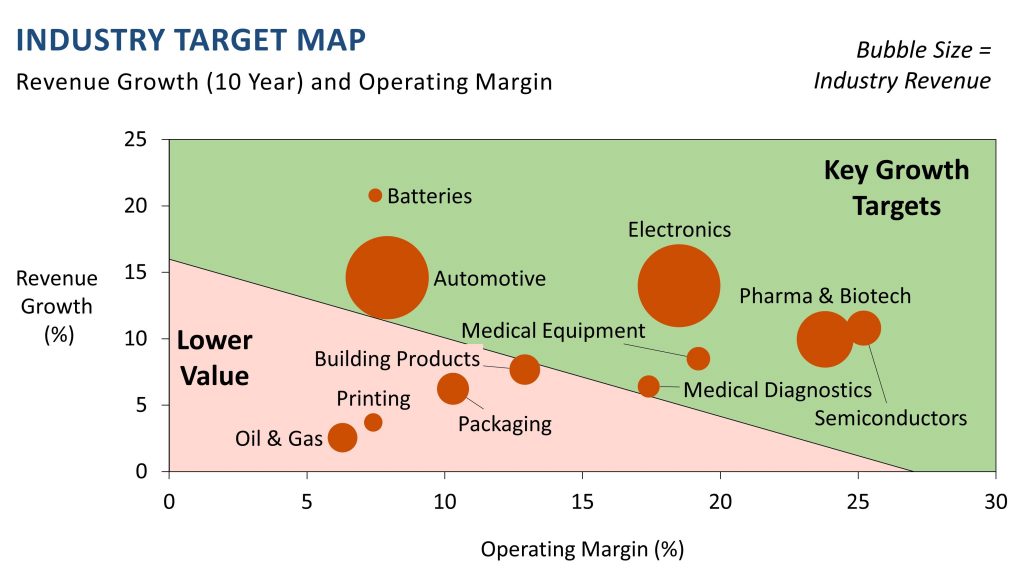

One common misconception in specialty chemicals is that the markets are all commoditized. However, there are many existing and emerging markets with high revenue and margin growth that are attractive targets for new product development and market expansion for specialty chemicals providers. Within these targets, a range of opportunities exist for your unique solutions.

So, here’s to your success in marketing for specialty chemicals. If you believe that your technology can still offer unique value, don’t just throw in the towel and follow the commodity route – instead, double down on getting closer to your customers so you can offer the perfect solution that suits both their needs and your portfolio requirements. It isn’t easy to provide this level of service – as the Four Seasons’ Isadore Sharp notes, the concierge must act as “a combination of personal secretary, aide-de-camp, tour guide, travel agent, social director, best friend and flat-out miracle worker” – but if you invest in creating rewarding experiences for your clients, they will reward you in return.

Find out how Newry can help your organization move smarter to move faster. Get traction in your market.