THE SITUATION

No Line of Sight to the End User

A materials manufacturer was pitching an anti-microbial additive to manufacturers of household paint but lacked the market insight needed to spur product development and negotiate advantageous pricing. While the client had a diverse portfolio of highly differentiated technologies and were involved in a wide range of end markets, they did not have any prior experience in the coatings space. They needed to understand consumer perception of anti-microbial paint to pique potential customers’ interest and establish the value their additive could bring.

The plight of the B2B company:

B2B materials companies face unique challenges when trying to sell into a consumer product – no line of sight into end user preferences, secretive customers, etc. – which makes it hard to go into negotiations with confidence. Consumer surveys and focus groups are a useful way to attack these issues, and thoughtful survey design can reveal unexpected routes to market through creative segmentation.

The Approach

Gathering Diverse Perspectives

When assessing the value of a new material or component, it’s important to solicit opinions from both end users and industry professionals. While consumer attitudes are often the most powerful driving force behind new product development, this group is often oblivious to the underlying technical attributes that shape their experiences. In contrast, technicians, contractors, and other experts may wield less power over a manufacturer’s design choices, but they can speak to the nuances of product performance with conviction.

For this project, we deployed several complementary research techniques simultaneously to obtain the information our client needed and triangulate our insights with expert feedback:

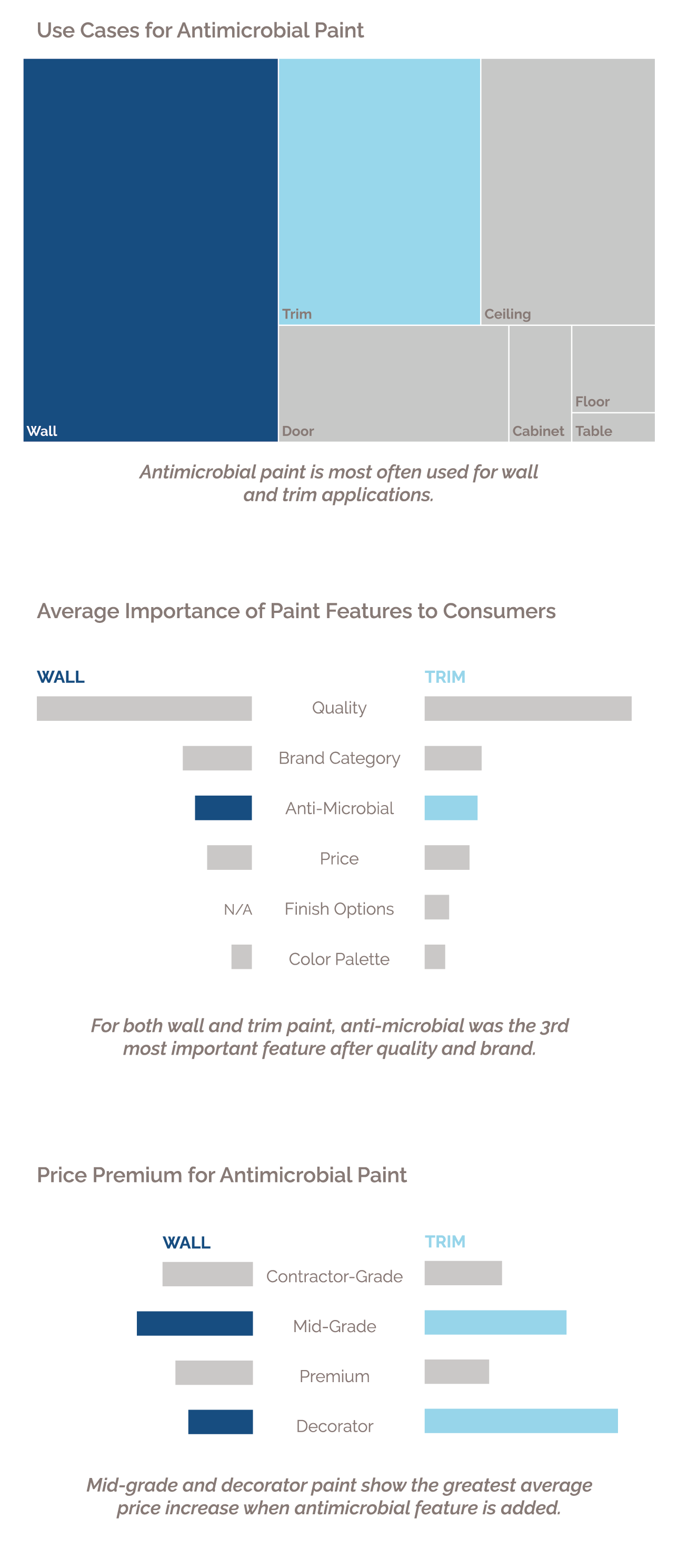

- Broad Consumer Survey: Responses from nearly 2,000 consumers across the US helped to gauge general perceptions of anti-microbial paint and likelihood of purchase

- Conjoint Analysis: This statistical technique uses survey data to determine preference and willingness to pay for individual product features or a product with a combination of new features

- Contractor Survey and Interviews: Because consumers often prefer to pay professionals to execute their painting projects (including recommendations for and selection of specific products), getting the perspective of contractors was critical

- Focus Groups: Once we had confirmed interest and willingness to pay, we conducted 7 focus groups in 3 cities to test and refine product description, use cases, and buying process

The Outcome

Empowered With Knowledge

The results of the consumer survey and conjoint analysis validated positive consumer perceptions and willingness to pay a premium, which enabled our client to go into customer conversations with confidence and strengthened their negotiating position.

Furthermore, our detailed segmentation of customer buying behavior revealed that the target customer segment was different from our customer’s original hypothesis, which fundamentally changed the way they thought about the product development.