3 Portfolio Management Lessons to Help You Get the Most Value Out of Your Core from the Oracle of Omaha

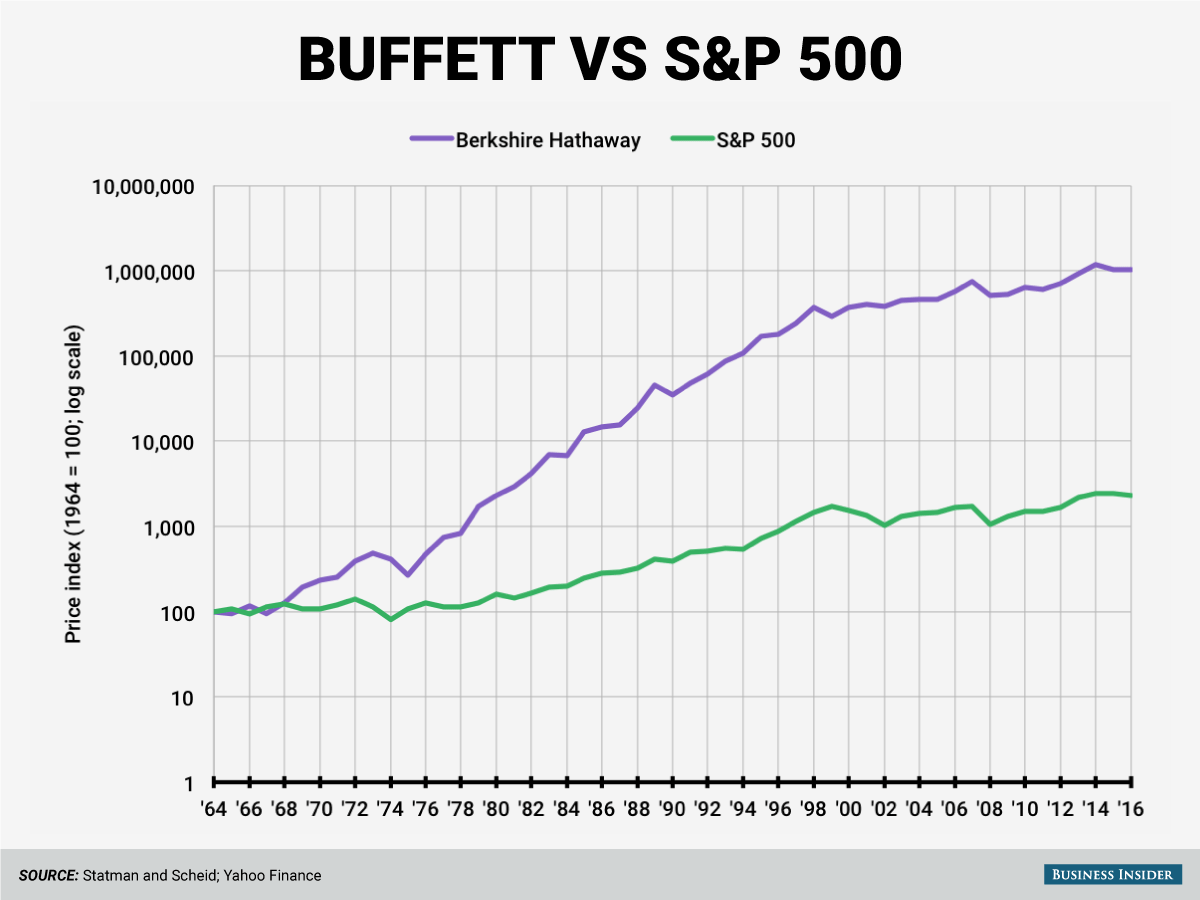

Warren Buffett is widely admired in the world of investing, and for good reason: since he became the majority shareholder of Berkshire Hathaway in 1964, the firm has outperformed the S&P 500 practically every year. This uncanny ability to pick stocks earned Buffett the nickname, “Oracle of Omaha.”

Buffett is also recognized as a great storyteller. His annual reports are full of clever aphorisms that convey his investing philosophy, and while his focus is the stock market, his wisdom can be applied in many other arenas – R&D portfolio management, for instance. We see many parallels between Buffett’s advice and Newry’s philosophy of “sticking to your core” by pursuing growth via near adjacencies. Here are three lessons from the Oracle that seem particularly apt for the world of technology-driven innovation:

Sometimes, going after a totally new market is worth the risk; sometimes, it’s your only option. But most of the time, it’s better to go after adjacencies where you already have some connections and knowledge of the technical requirements – otherwise, it’s tough to discern what it will take to win.

Recently, one of our clients decided to pursue an opportunity in a completely new-to-them market: architectural building materials. Our client had no previous business experience or customer relationships in this space, but it was a big market, and they felt confident that they could deliver value in the form of significant energy savings.

There was just one problem: as Newry started interviewing architects around the globe, it became clear that our client lacked an understanding of end users’ priorities, and their hypothesized core value proposition didn’t resonate. These key decision-makers had some interest in energy savings, but ultimately, aesthetics were everything – and our client’s product didn’t measure up.

When people describe innovation, they often talk about transformational technology programs that create entirely new market platforms – but in many cases, there is underrated value in incremental innovation. Flashy breakthroughs are exciting, but they require time and risk and lots of money; incremental improvements that build on core capabilities and existing relationships, on the other hand, usually go straight to the bottom line.

One of our clients, a Fortune 500 specialty materials company, has embraced this principle and reaped the rewards. Over half of their large R&D budget goes toward cost reduction and product extension programs, and while they invest about 8% of sales into RD&E compared to the 4% of their competitors, they consistently deliver more than double the operating margin (20% vs. competitors’ 9% average). This strong focus on investing in innovation, and specifically incremental innovation close to their core, has paid off in a huge premium.

Warren Buffett’s core value investing strategy is based on one simple principle: invest in stocks that the market has priced lower than what they are intrinsically worth. For R&D portfolios, this means investing in projects where you have a competitive advantage that enables you to capture more value for a lower price than other players in the market. This advantage may come from market position, technical expertise, existing resources and assets, etc. A core-focused strategy introduces synergies that set you apart from other competitors trying to enter the market.

It’s worth noting that in the materials space, this competitive advantage needs to be built before it can be exploited – but the investment is worth the return. For instance, one of our clients has spent decades developing and building a platform of differentiated fluoropolymer processing capabilities. Today, they can leverage their deep expertise and existing resources to enter new markets quickly and economically, whereas the price for other market players to enter and catch up is prohibitively high. As a result, they can capture significant value for a relatively lower price.

So, the next time you think of Warren Buffett or read one of his annual reports, don’t just think about him as an investor in the stock market; think about him as an expert in maximizing value, and consider whether his insights might be applicable to your world. As the Oracle himself would say, “Chains of habit are too light to be felt until they are too heavy to be broken.” Check your portfolio management habits now, and if they aren’t aligned with your core, consider changing them. You’ll be glad you did.

Find out how Newry can help your organization decide where to focus. Have conviction and validation about the opportunities you’re pursuing.