As the global energy transition from fossil fuels to renewables accelerates, solar power is enjoying a great deal of attention and funding. However, unlike many other sustainability tech darlings–electric vehicles, direct air captures, etc.–solar is not new; in fact, the industry is quite mature, with a well-established value chain and highly efficient manufacturing processes. The biggest issues when it comes to solar panel adoption are often quite pedestrian (e.g., securing permits and supply, identifying where to put them, etc.), and as such, there are limited opportunities to enter the market on the basis of a unique technical advantage and compete. Still, the massive upswell in demand coupled with shifting policy dynamics and interesting (if incremental) technology advances could potentially create some opening for intrepid new players in the next several years. Here are several factors shaping the future of solar energy:

Policy-Driven Demand

Solar is expected to play a significant role in decarbonizing the global economy and averting the worst effects of climate change. Renewables offer lower carbon intensity relative to conventional power sources, delivering a 95% and 98% reduction for solar and wind relative to coal, respectively. Solar is also one of the lowest levelized cost of electricity sources. New-build solar is now cheaper than new-build coal- and gas-fired power in many markets, including the US, India, Germany, Italy, Spain, France, Australia, and South Africa.

But as promising as this all sounds, the reality of what it would take to hit net zero emissions targets by midcentury–i.e., quadrupling the annual pace of solar panel and wind turbine installations by 2030–is staggering, and likely impossible to achieve without major policy interventions. Fortunately, governments are starting to take action by either incentivizing adoption (as with the Inflation Reduction Act [IRA] in the US, which also incentivizes domestic production) or mandating it (e.g., the French Senate has passed legislation requiring parking lots with at least 90 spaces be covered in solar panels). Assuming this trend continues, the already growing demand for solar will explode, creating an opportunity significantly large enough for many players to reap the rewards.

Shifting Geographies

The first photovoltaic (PV) devices was invented in 1954 at Bell Labs, and for the next three decades, the technology was largely developed in the US. US dominance waned in the 1990s as Japan and Germany scaled their activity, and by the 2000s, China was dedicating significant public funding to scaling solar production. These government subsidies drove down PV pricing significantly, making it difficult for US-based players to compete, even with tariffs–and by the late 2010s, no US-based wafer or cell manufacturing capacity remained. Now, China accounts for ~72-96% of global production capacity.

Today, however, the trend toward reshoring of manufacturing we’ve seen in semiconductors, pharmaceutical development, and other critical industries is also impacting solar. For example, in response to incentives offered via the IRA, we’ve already seen announcements for cell and module capacity expansion that in total are on par with current domestic demand and would represent a five-fold increase over existing module capacity. Independent of policy, increases in shipping costs since the start of the pandemic have also provided a boost for the competitiveness of domestically produced modules. Still, margins remain very tight and there is currently some global excess capacity, so new US entrants will need to operate diligently and invest in process automation and innovation to control costs and remain competitive in the long term.

Technological Advances

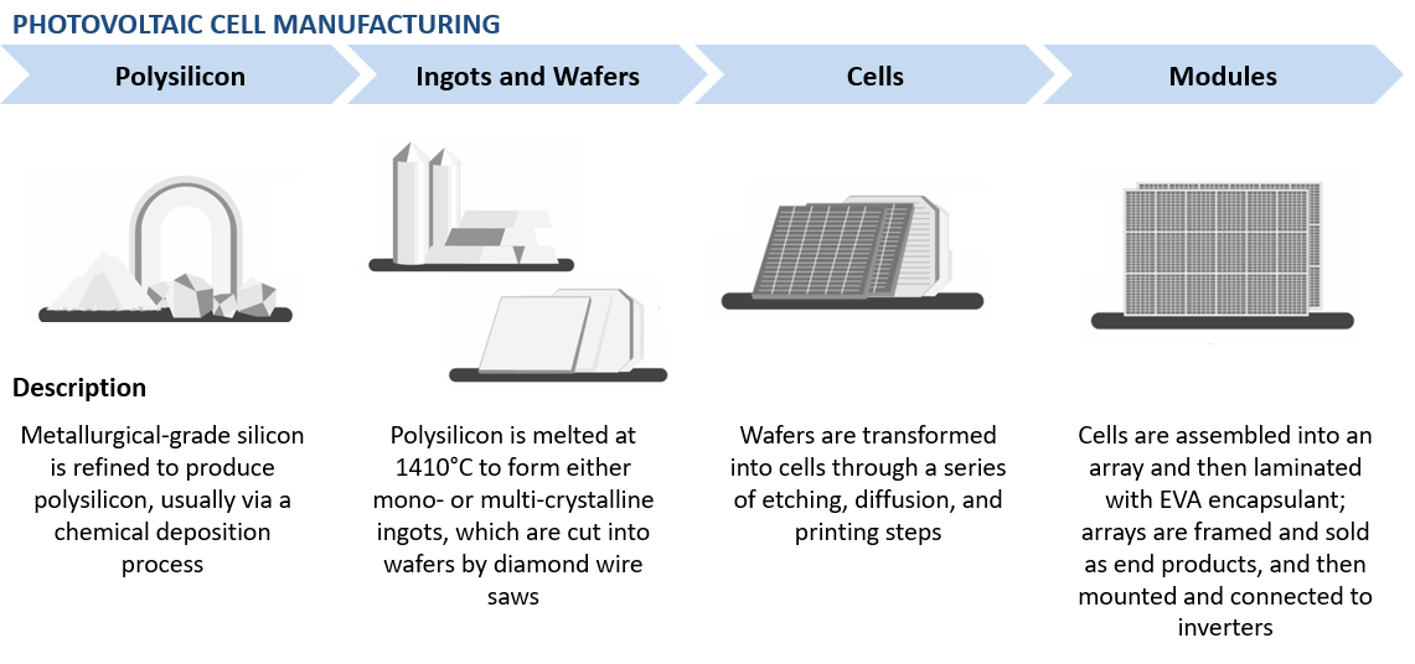

The process for constructing PV cells is well-established: first, metallurgical-grade silicon is refined to produce polysilicon, usually via a chemical vapor deposition process. The polysilicon is melted at 1410°C to form either mono- or multi-crystalline ingots, which are then sliced into wafers using diamond wire saws. Those wafers are transformed into cells through a series of etching, diffusion, and printing steps. To make the final module, multiple cells are assembled into an array, laminated with an EVA encapsulant, and framed. These modules are then mounted and connected to inverters, enabling them to capture passive energy from sunlight and convert it to an electron flow current.

While PV technology is highly optimized, innovations continue to emerge at each step of production. Ingot manufacturers are transitioning to different dopants to ultimately minimize cell degradation and boost efficiency, while wafer makers are shifting to larger sizes and cell manufacturers are adopting new, more efficient architectures. The impacts of these modifications will be incremental, but even a sub-1% improvement in efficiency may be meaningful as long as the gain offsets any increase in production cost. More significant materials- and process-related breakthroughs are on the horizon as well, although the timing and viability of these changes are less certain; depending on the extent to which policy impacts supply and demand dynamics, there could be some truly compelling opportunities for new offerings in this mature industry over the next 3-10 years.

While PV technology is highly optimized, innovations continue to emerge at each step of production. Ingot manufacturers are transitioning to different dopants to ultimately minimize cell degradation and boost efficiency, while wafer makers are shifting to larger sizes and cell manufacturers are adopting new, more efficient architectures. The impacts of these modifications will be incremental, but even a sub-1% improvement in efficiency may be meaningful as long as the gain offsets any increase in production cost. More significant materials- and process-related breakthroughs are on the horizon as well, although the timing and viability of these changes are less certain; depending on the extent to which policy impacts supply and demand dynamics, there could be some truly compelling opportunities for new offerings in this mature industry over the next 3-10 years.

Find out how Newry can help your organization find high-value options for growth. Expand your pipeline before it runs dry.