How Electric Vehicles Are Causing A Disruption Across Their Value Chains

On September 26, 2017, James Dyson (of vacuum and hand dryer fame) announced that his company had begun working on an electric vehicle, with a launch planned for 2020. At first blush, this proposition seemed outlandish to many:

But, as Colin McKerracher of Bloomberg New Energy Finance noted, “Dyson knows a lot about motors, batteries, and consumer tastes, and has enviable R&D capability. [They’re] certainly not the craziest hat in the ring.”

Breakthrough technologies like electric vehicles can lay waste to preexisting value chains, abruptly dethroning dominant players and opening the market to unexpected new entrants. However, as anyone familiar with megatrend analysis knows, the threats and opportunities that arise as a result of disruptions on this scale are rarely predictable or easy to exploit, and suppliers who don’t proactively monitor the shifting landscape of their OEM customers run the risk of getting left behind.

Newry recently did some work for a client with a large automotive components business who needed to understand, realistically, what impact electric vehicles might have on their business. What we found was that they were, indeed, likely to get disrupted – but so, too, was almost every other traditional automotive materials supplier, manufacturer, and service provider. Here are a few of the biggest areas of flux that will affect our client and their peers:

Evolving Content

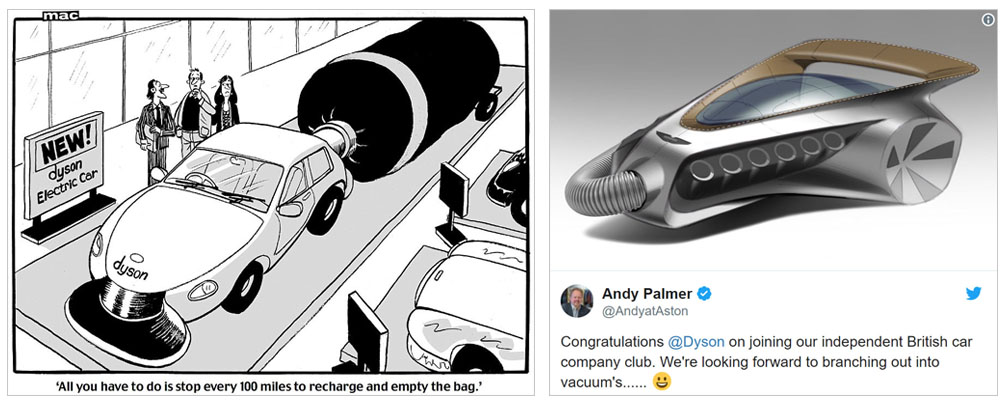

On the most basic level, electric vehicles are made of very different “stuff” than traditional ICE vehicles, which has major implications for any materials supplier already operating in the automotive space – and many who don’t participate yet. Most obviously, battery raw materials (particularly cobalt, lithium, and nickel) will be in high demand as EVs gain adoption, as will expertise in complex electronics.

But while the electronics are more complex, the cars themselves are simpler: Goldman Sachs estimates there are only 11,000 components in the average electric vehicle, compared to 30,000 components in an ICE car. This means that material suppliers may be selling a lot less material overall (there are only 9kg of polymer in the Chevy Bolt, compared to 24kg in the VW Golf), and emissions controls businesses and other ICE-specific component makers will lose out in the simplified drive train.

Evolving Business Models

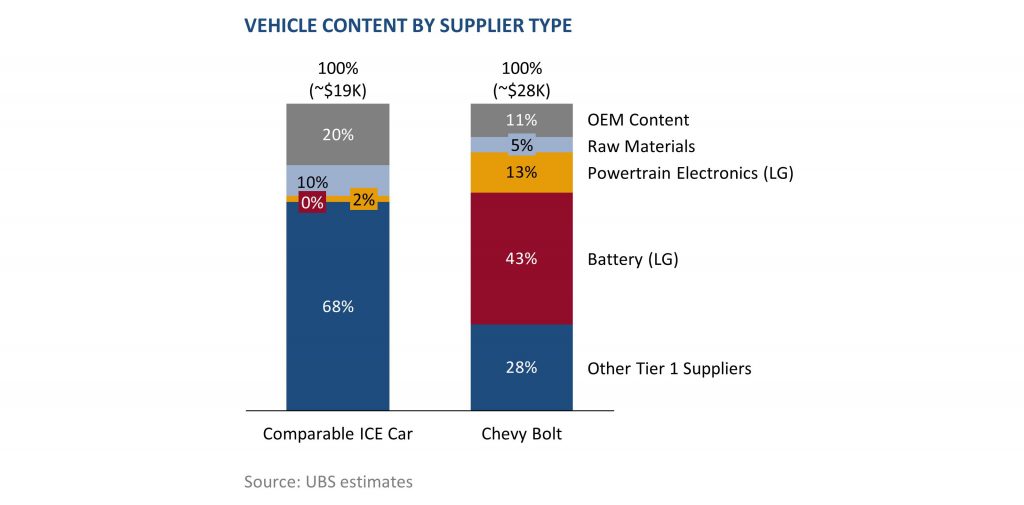

With changing technology content, the expertise required to manufacture an electric vehicle is also evolving and creating new implications for business models. Many OEMs are sourcing components externally rather than differentiating themselves with internally developed, proprietary drivetrain technology. This strategy could decrease their EBIT but potentially increase ROIC.

As opportunities to source automotive components externally increase, the technology-based barriers to competition diminish, creating a new entry point for startups and other non-traditional players. However, the operating costs required to establish a brand and sales network will likely remain high, and new entrants’ ability to compete long-term remains to be seen.

Evolving Geographies

While 35 of the top 50 conventional Tier 1 suppliers are headquartered in Japan, Germany, and the US, the lithium ion battery industry is centered elsewhere. China and South Korea stand out as notable additions, accounting for approximately 54% and 16% of the 2017 global commissioned lithium ion battery capacity for electric vehicles, respectively. Furthermore, China plans to triple its capacity by 2021, growing its potential market share to approximately 67%.

Beyond batteries, the Chinese government is investing heavily to ensure that the global emergence of electric vehicles will be centered in China, enabling China to become a leader in automotive manufacturing and to leapfrog traditional OEMs. The lion’s share of production is expected to happen in Asia – a major shift in the geographic dynamics of the automotive market.

Evolving Aftermarket

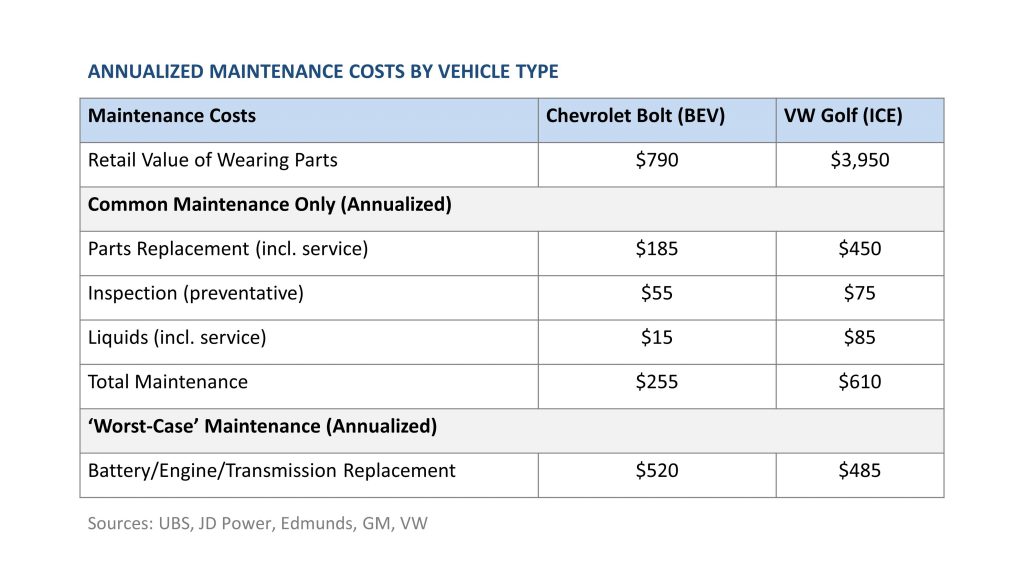

Not only are electric vehicles manufactured differently, they also perform very differently than ICE vehicles, which threatens to disrupt aftermarket players. Electric vehicles have significantly lower maintenance costs relative to ICE vehicles, which will impact mechanics and dealerships alike. Part and fluid replacement needs will diminish – after all, the Chevy Bolt only has 35 wearing and moving parts in its powertrain compared to 167 for the VW Golf, and does not require oil or transmission fluid changes. The only component that is expected to wear faster in a battery electric vehicle than in an ICE vehicle is tires, due to the higher curb weight and torque of electric vehicles.

This will have important implications for service and replacement part suppliers who may need to consider new business models. For example, UBS estimates that although parts and service only account for 13% of dealerships’ revenue, they account for 43% of gross profits on average. Dealerships will need to consider new options to maintain their profitability.

There’s no question that the automotive market is changing with the shift to electrification, along with shared mobility and autonomous vehicles. Evolving technologies and business models will certainly create new opportunities for many, and threats for others. The winners of the EV market will be those that are able to think creatively to transition their portfolio while minimizing exposure to legacy ICE-associated businesses. Many are already doing this; for example, Johnson Matthey, BASF, and Umicore – leading players in the autocatalyst market for combustion engine emissions controls – all see the writing on the wall and are investing to play in this new market by establishing their position in cathode materials for lithium ion batteries.

The good news is that the market has not yet converged on one technology solution or business model – players can still harness their creativity to find new opportunities to innovate and win in this evolving market. Building on core capabilities and relationships – be it technical capabilities to address unsolved material problems related to heat management and energy density, or service networks and relationships to create new aftermarket business models – in a creative way can help define new opportunities. After all, if Dyson can leverage their technical expertise to build a business case, why not you?

Find out how Newry can help your organization anticipate future needs and stay ahead of disruptions. Don’t wait until you’re left behind.