The Hurdles of Healthcare Product Commercialization

The US healthcare system is big news these days, with the status of the Affordable Care Act still in question despite the failure of several legislative repeal/replace efforts earlier this year. But this conversation isn’t new: healthcare reform has been a constant talking point for the last half century, and rampant dissatisfaction with the inefficient and complicated current system has motivated politicians and constituents on both sides of the aisle to effect change – with limited results.

The most obvious victim of the complexity of the healthcare system is the individual patient, but the dysfunction of the institution also places an onerous burden on companies attempting to commercialize innovative products and technologies. Bringing a product to market in any industry is a complex process that requires diligence, creativity, and a certain amount of luck, but healthcare commercialization demands particular attention, care, and tolerance for risk, for three main reasons:

- The ecosystem of players is overwhelmingly convoluted and characterized by misaligned incentives and unequal balances of power

- Uncertainty surrounding reimbursement and regulation increases risk and slows progress

- The evolving and potentially imminently changing legislative environment throws into question any and all assumptions about revenue streams, channel strategy, and other business model components

There is no silver bullet for overcoming these barriers – only methods to reduce risk and uncertainty – but the potential upside in improved health and patient outcomes, as well as financial rewards, is immense. We will discuss our experiences in helping clients tackle these challenges, and offer some perspectives on what we think are the best ways to mitigate the hazards of healthcare commercialization. Today, our focus is the ecosystem: who’s involved, where the power lies, and how to navigate these factors effectively.

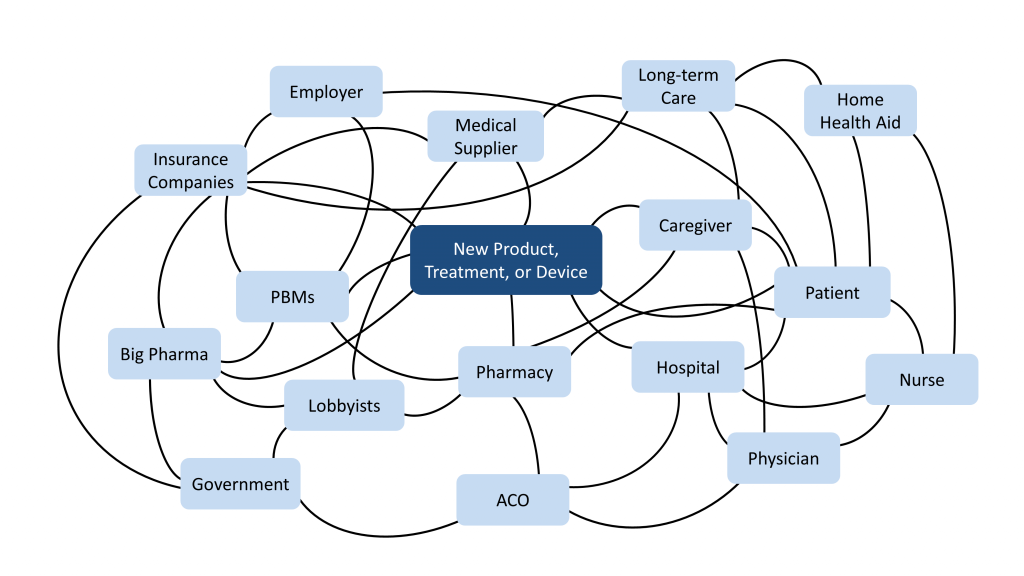

The healthcare ecosystem is vast, interconnected, and complicated by the presence of middle-men, regulation, and gatekeepers. The figure below shows an illustrative view of the various players and their many overlapping relationships.

Fig. 1: A new device or product (dark blue) must be placed within the context of the interconnected healthcare ecosystem with multiple players (blue) who have very different incentives

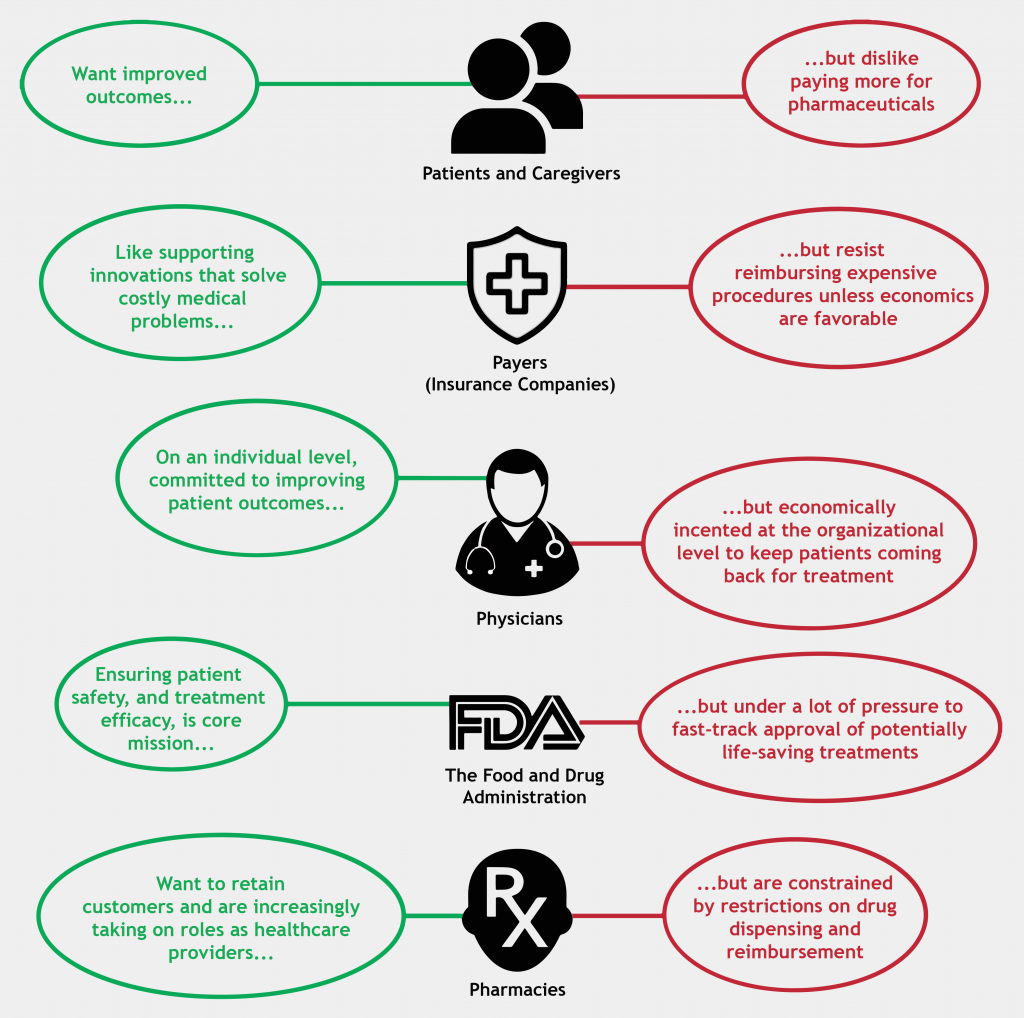

The downstream supply chain for a new pharmaceutical product, for example, includes approval by the FDA, specification by pharmacy benefit managers into their formularies (see below), prescription by physicians, and dispensing by pharmacists, all before a drug reaches the patient. Every one of those players, including the patient and potential caregivers or guardians, may have different incentives for supporting the drug. Here are a few examples:

In addition to these many competing incentives, asymmetrical distribution of power within the healthcare ecosystem further complicates the landscape. For example, in order to remain in “preferred pharmacy networks”, pharmacies must pay mandatory fees to pharmacy benefit managers, or PBMs. These shadowy middle-men determine which drugs will be covered and how much your pharmacist will be paid for dispensing them. Due to their large market share and consolidation (the biggest 3 PBMs control ~80% of the insured patient population), they exert enormous influence on the ecosystem and throttle healthcare product commercialization.

“Nobody knew healthcare could be so complicated.”

– Donald J. Trump

With this level of complexity, commercializing a new product can be a daunting task. Indeed, success in this industry is elusive even without accounting for the onerous technical challenges and regulatory burdens, which may account for the high level of consolidation among medical device and pharmaceutical manufacturers. There are, however, ways to mitigate risk and improve your odds of success. In our experience, the following analyses can help deconstruct this ecosystem and avoid potentially fatal commercialization pitfalls:

1. Understand the players’ power and influence

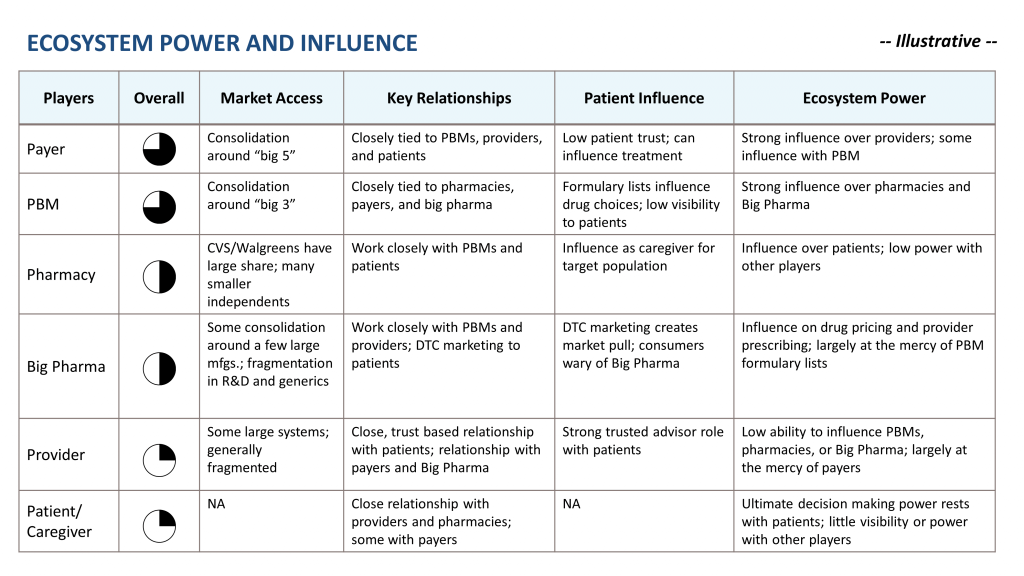

In the healthcare ecosystem, several factors determine a player’s level of power and influence: their market access (often increased through consolidation), their relationships with other players, and their control of patient decisions. All these factors contribute to overall ecosystem power, which often takes the form of economic influence over other players.

For example, due to their large market consolidation and connections to payers, pharmacies, and “Big Pharma”, PBMs exert enormous influence within the healthcare ecosystem. Conversely, despite having a tremendous amount of influence over the patient, providers are generally fragmented and have little ability to exert influence over more economically powerful players. The analysis below, while qualitative, helps establish context around the relationships within the ecosystem as well as identify players with the right type of ecosystem power to factor into commercialization plans.

2. Determine how the influential players would react to your product

As Martin Ihrig and Ian MacMillan discussed in their recent HBR article, developing an understanding of an unfamiliar ecosystem’s needs and tensions, and understanding how your product introduction will be viewed, is critical to gaining commercial traction.

Take for example the introduction of a new high-cost drug treatment that has some adverse side effects but replaces the need for a future surgical intervention. In this instance, the insurer pays more money up front for a drug with the hope that the treatment will eliminate an expensive surgical procedure later on. However, not everyone benefits. Here, the patient undergoes weeks of drug treatment with negative side effects, and the hospital provider forgoes potential future revenue from the surgery.

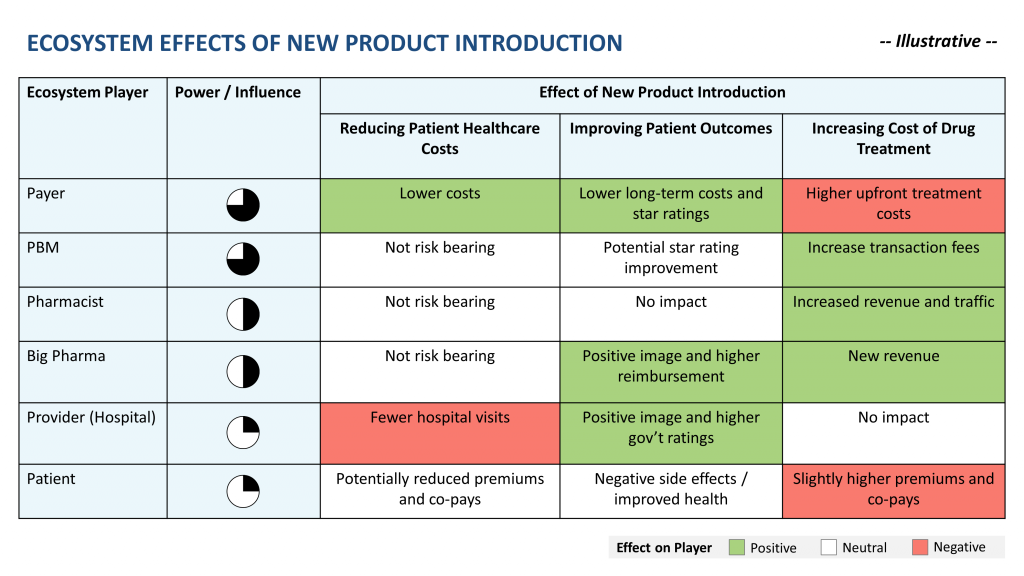

The chart below illustrates one approach to mapping these dynamics and the effect that a new product introduction, such as the release of a novel drug, could have on the healthcare ecosystem. This sort of analysis can be especially useful in revealing potential allies (and opponents).

Bear in mind that certain factors, such as the weight of government incentives like star ratings (which rate payers and providers across a variety of metrics including patient outcomes, experience, and access), may increase or decrease in importance depending on legislative changes. Additionally, it is important to note that this analysis reflects cold economic realities among an aggregation of players, not the personal feelings of any one particular patient, provider, pharmacist, or insurance adjuster. No one wants patients to get worse or is neutral about improving patient outcomes; however PBMs and pharmacists, for example, are ultimately incentivized to sell more drugs.

Ecosystem complexity is not a unique feature of healthcare product commercialization. The same types of analysis to understand the players involved, their power and influence, and their reaction to a new product’s introduction can and should be used in the commercialization of any new product, though it may be uniquely important in this space.

Find out how Newry can help your organization move smarter to move faster. Get traction in your market.